AMD reports earnings; What’s on the cards? – Stock Market News

Advanced Micro Devices (AMD) will release its latest earnings on Tuesday, August 1, after Wall Street’s closing bell. Earnings are expected to have declined from last year, amid a sharp slowdown in gaming demand. Nonetheless, AMD shares have risen 76% so far this year, as investors are razer-focused on the company’s future prospects in the AI revolution.

AMD shares storm higher

It has been a magnificent year for AMD shareholders. With the hype surrounding artificial intelligence (AI) reaching fever pitch, investors have rushed to increase their exposure to AMD, as it is essentially the only chip designer that can currently compete with Nvidia in the AI wars.

Although AMD was late to join the AI party, it is trying to make a grand entrance. Last month, the company unveiled its MI300 chip, which has been touted as the world’s most advanced accelerator for generative AI. That means the chip is ideal for training large language models such as ChatGPT, which have burst into the scene lately.

Similarly, AMD has become a bigger player in cloud computing and data centers. While Nvidia currently dominates this market, AMD has been taking market share, and is releasing new variations of chips specialized for data centers. In fact, some recent reports suggest Amazon’s cloud unit is considering using AMD chips, which would be huge since Amazon is the world’s largest cloud provider.

Similarly, AMD has become a bigger player in cloud computing and data centers. While Nvidia currently dominates this market, AMD has been taking market share, and is releasing new variations of chips specialized for data centers. In fact, some recent reports suggest Amazon’s cloud unit is considering using AMD chips, which would be huge since Amazon is the world’s largest cloud provider.

Earnings decline

Even though AMD’s future seems bright, the present is challenging. Over the last year there has been a sharp slowdown in demand for gaming components, such as processors and graphics cards, which are still the company’s bread and butter.

As such, the upcoming results are expected to be ugly. For the second quarter of 2023, analysts expect revenue to have declined by 19% and earnings to have fallen by 45.5% compared to the same quarter last year.

Normally, these would be terrible results and a major source of concern for investors. However, most of this weakness is essentially a post-pandemic hangover as many clients over-ordered during the lockdown shortages, which essentially pulled demand forward. The company is now dealing with the aftershocks.

In general, investors are much more interested about any AI plans, viewing that as a much bigger market than gaming could ever be. The stock’s stellar performance this year suggests that as long as the AI dream is alive, traders are willing to overlook any short-term obstacles such as this one.

Therefore, the subsequent conference call with the company’s management might be even more important than the earnings numbers themselves. The guidance provided by CEO Lisa Su for the next quarters will likely overshadow everything else in terms of market impact.

Therefore, the subsequent conference call with the company’s management might be even more important than the earnings numbers themselves. The guidance provided by CEO Lisa Su for the next quarters will likely overshadow everything else in terms of market impact.

From a chart perspective, AMD shares have been in a clear uptrend since bottoming out in October, recording a series of higher highs and higher lows. The most important level to watch on the upside is the 121.5 zone, while on the downside, any declines below the 107 region could signal that the uptrend is unraveling.

Valuation is pricey

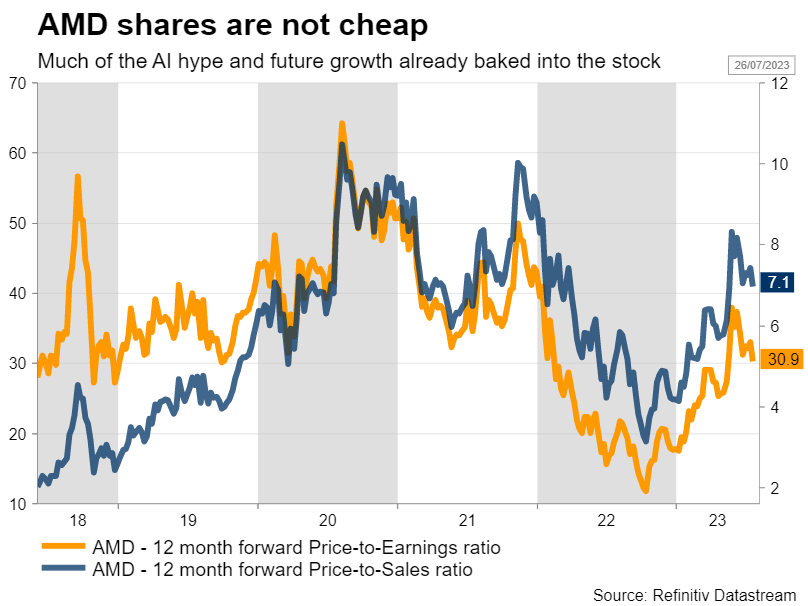

Turning to AMD’s valuation, the stock is not cheap. Shares are trading for 30 times what analysts expect earnings to be over the next year, which suggests that a lot of future growth is already baked into the cake.

This valuation has nearly tripled since October, as the share price rallied but earnings declined, making the stock increasingly more expensive. AMD shares have been even more expensive in recent years, but that was during a period of booming profit growth.

In other words, the shares already reflect investor expectations that the AI-driven growth will help AMD boost its profits in the future. Hence, for the share price to move even higher and aim for new record highs, the company will need to exceed these rosy expectations.

Overall, even though the stock’s valuation is pricey, AMD seems well positioned to grow over the coming years. It has managed to surpass Intel in processors and is rivaling Nvidia in graphics cards for gaming. If it manages to pull off a similar feat in the space of AI chips, that could be a game changer both for the company and the stock.

Aset Terkait

Berita Terbaru

Pengungkapan: Entitas XM Group menyediakan layanan khusus eksekusi dan akses ke Fasilitas Trading Online kami, yang memungkinkan Anda untuk melihat dan/atau menggunakan konten yang tersedia pada atau melalui situs, yang tidak untuk mengubah atau memperluas, serta tidak mengubah atau memperluas hal tersebut. Akses dan penggunaan ini selalu sesuai dengan: (i) Syarat dan Ketentuan; (ii) Peringatan Risiko; dan (iii) Pengungkapan Penuh. Oleh karena itu, konten disediakan hanya sebagai informasi umum. Anda juga harus ketahui bahwa konten Fasilitas Trading Online kami bukan sebagai ajakan atau tawaran untuk untuk melakukan transaksi apa pun di pasar finansial. Trading di pasar finansial mana pun melibatkan tingkat risiko yang signifikan pada modal Anda.

Semua materi yang diterbitkan di Fasilitas Trading Online kami hanya untuk tujuan edukasi/informasi dan tidak boleh mengandung nasihat dan rekomendasi finansial, pajak investasi atau trading, catatan harga trading kami, penawaran, permintaan, transaksi dalam instrumen finansial apa pun atau promo finansial untuk Anda yang tidak diminta.

Konten pihak ketiga apa pun, serta konten yang disiapkan oleh XM, seperti opini, berita, riset, analisis, harga, informasi lain atau link ke situs pihak ketiga yang tersedia "sebagaimana adanya", sebagai komentar pasar umum dan bukan menjadi nasihat investasi. Sejauh konten apa pun ditafsirkan sebagai penelitian investasi, Anda harus memperhatikan dan menerima bahwa konten tersebut tidak dimaksudkan dan belum disiapkan sesuai dengan persyaratan hukum yang dirancang untuk mempromosikan kemandirian riset investasi dan dengan demikian akan dianggap sebagai komunikasi pemasaran di bawah hukum dan peraturan yang relevan. Mohon dipastikan bahwa Anda telah membaca dan memahami Notifikasi pada Riset Investasi Non-Independen dan Peringatan Risiko kami mengenai informasi di atas, yang dapat diakses disini.